The last 24 hours has seen many of the, what I will charitably call, speculative stocks (and other assets) have large corrections. With I’m not sure the party is over, this is likely a trend to continue.

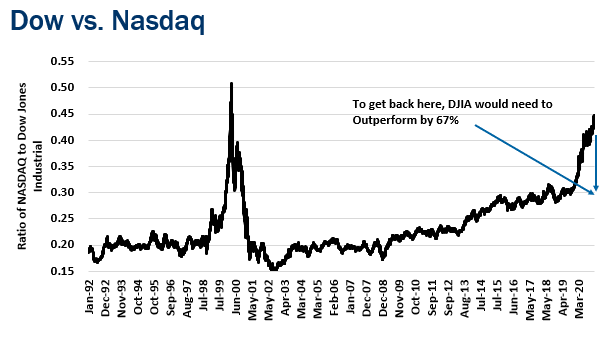

This is a graph of the ratio of the NASDAQ Composite to the Dow Jones.

Even after yesterday, the DJIA would need to outperform the NASDAQ by 67% (!!!) to get back a more normal ratio.

Could it be different this time? Maybe….. but I’d take the DJIA over the NASDAQ the next few years.