Everyone has been raving about the Japanese Stock Market this year. At first glance, it’s had a great year. Just one, small technical problem: You would have rather owned the S&P 500 this year. Why? The Yen.

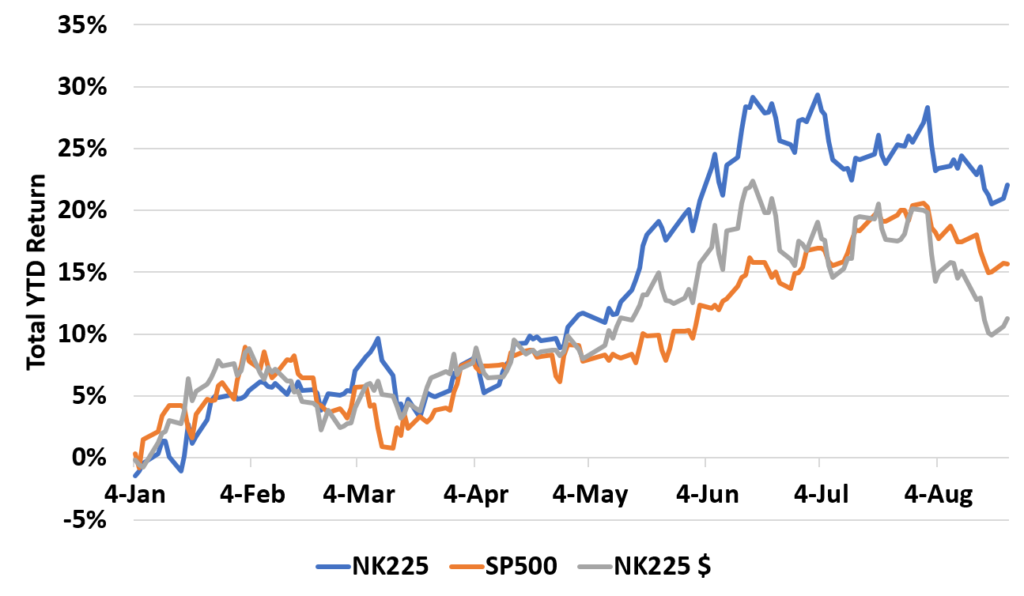

Here’s a graph of the S&P 500, the Nikkei 225 in Yen, and the Nikkei 225 in dollar terms. Of course this is the actual value to compare to the S&P 500.

The Nikkei 225 is up almost 25% in Yen terms, but it’s only up 11% in dollar terms whereas the S&P 500 is up over 15%. The reason the Japanese market is doing so well is simply the Yen is down 11% this year.

Historically, there is no reason to invest internationally. If the US market is doing well, you don’t want to own international stocks. When the US crashes, others crash just as much.

By the way, is this a good time to mention the Nikkei 225 is 17% below it’s all time high …. set in 1989?