Gold has been on a tear! It’s now over $2000. Why? For the same reasons I explained in January: Would you rather make a 0% return or a -1% Return?

Currently, real returns – returns after adjusting for inflation – are -1% on U.S. Treasury bonds. Yes that’s right. If you buy a 10 Year Government bond you are locking in a -1% real return for the next 10 years.

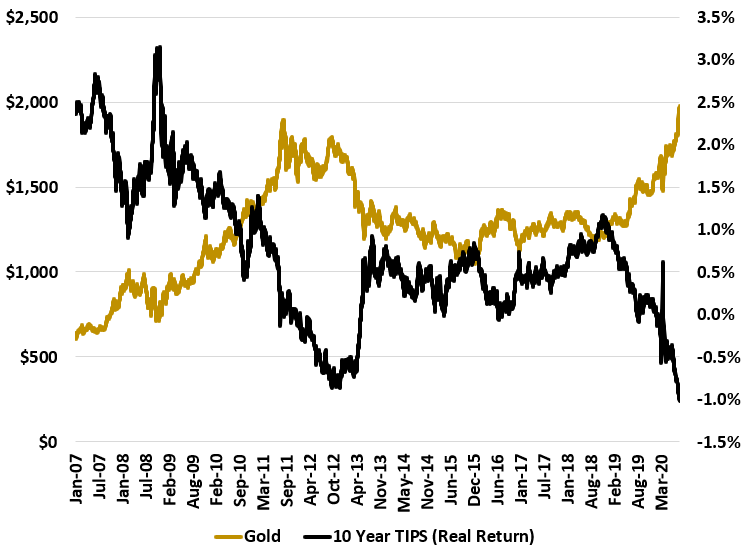

Well, each year you don’t lose 1% of your Gold. Thus, people would prefer to own gold than to lose money to inflation. Here’s a chart of Gold prices and the yield on a 10 year TIP bond, which is the real rate of return you will earn.

The question is…. when do real rates start heading back up? Because once that happens, Gold’s glitter will be gone.

I think Gold has moved too much here and moved more into high dividend stocks. Dividends offer me a real return as well as price appreciate. Plus food companies have pricing power if we do get inflation.