H/T to my friend Bill McBridge at calculatedriskblog.com who keeps posting insane data on the housing markets…

- Sacramento: Sales up 52%, Inventory down 45%, 0.7 Months Supply

- Maryland: Sales up 27%, Inventory Down 61%, 0.8 Months Supply

- Colorado: Sales up 41%, Inventory Down 66%, 0.7 Months Supply

- Houston: Sales up 58%, Inventory Down 43%, 1.4 Months Supply

- South Carolina: Sales up 41%, Inventory Down 56%, 1.3 Months Supply

- Portland (OR): Sales up 46%, Inventory Down 53%, 0.8 Months Supply

- New Hampshire: Sales up 13%, Inventory Down 57%, 0.8 Months Supply

- Boston: Sales up 35%, Inventory up 9%, 1.8 Months Supply

- Atlanta: Sales up 32%, Inventory down 65%, 0.8 Months Supply

- North Texas: Sales up 33%, Inventory down 65%, 0.6 Months Supply

The only silver lining for buyers is month-over-month inventory has started to rise in most places. Unfortunately, that’s also a seasonal thing.

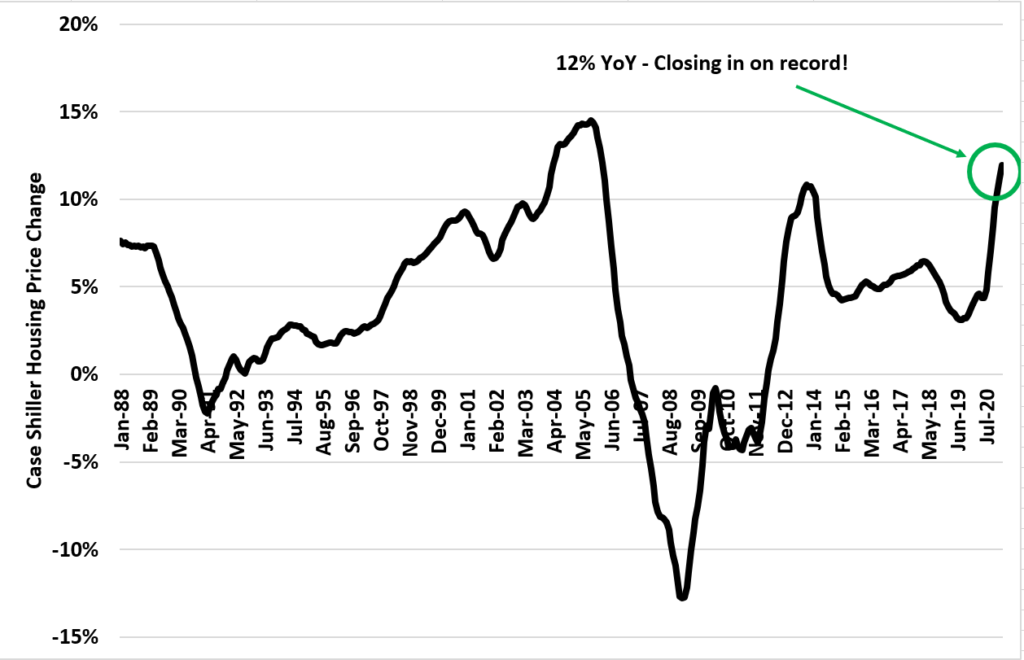

With inventory numbers like this, housing prices will continue their rapid increase even with slightly higher rates and inventory.