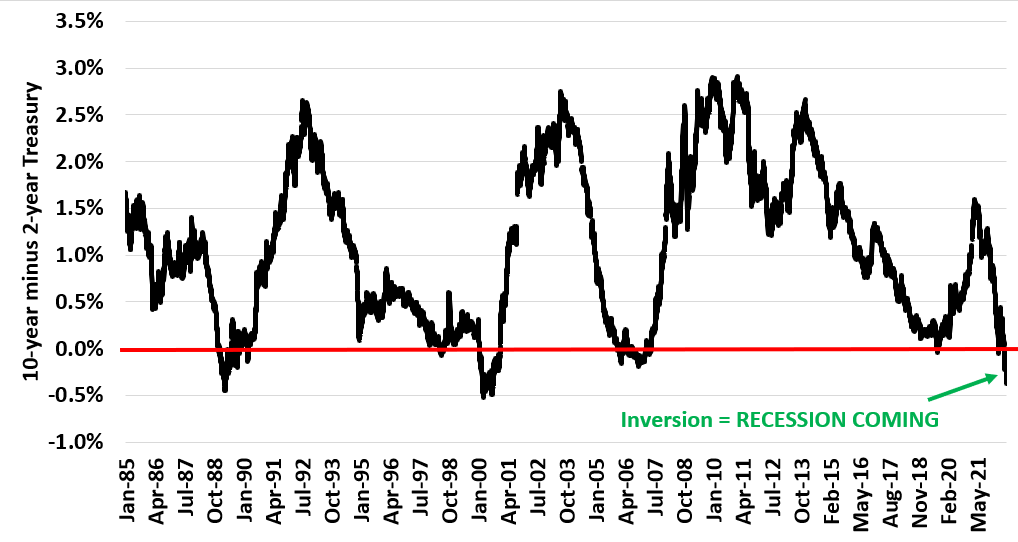

The yield curve has a solid inversion right now, indicating we will have a recession in the next 12 to 18 months. Given the accuracy of this indicator, you can pretty much put it in the bank.

Over the last 70 years, we essentially have never had a recession without an inversion and never had an inversion without a recession. We call that an accurcate indicator with high power.

The only question now is how bad will the recession be. A lot of that will depend on how persistent inflation is and how high the Fed needs to go. Given current labor market conditions are, the Fed will likely need to really tighten, negatively impacting areas of the economy that are already very weak.