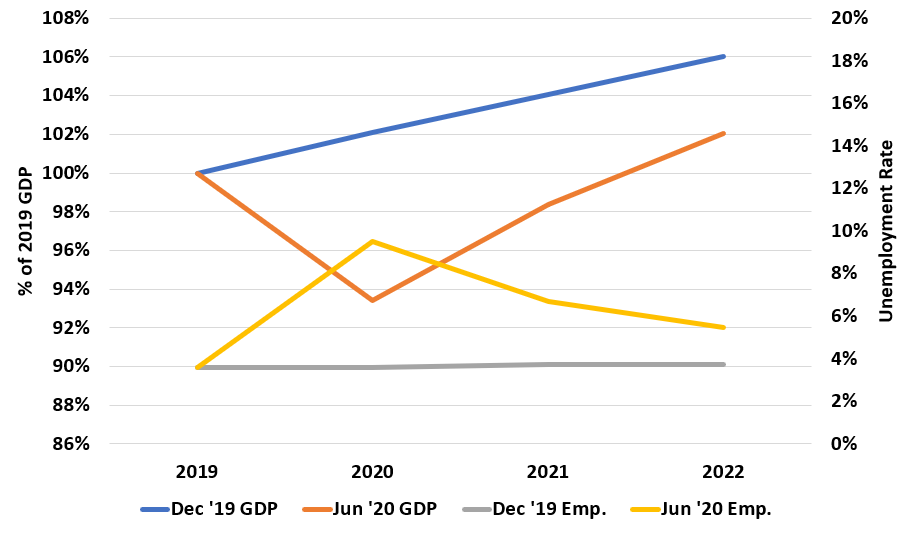

The Fed kept rates steady. More interesting is the updated Fed’s projections for the economy. Below are a comparison of GDP growth (as percent of 2019 GDP) and the unemployment rate.

You can see even at the end of 2021 the Fed does not think we’ll be back to 2019 GDP. At the end of 2022 we won’t be back to 2019 unemployment.

These projections suggestion a very long recovery.