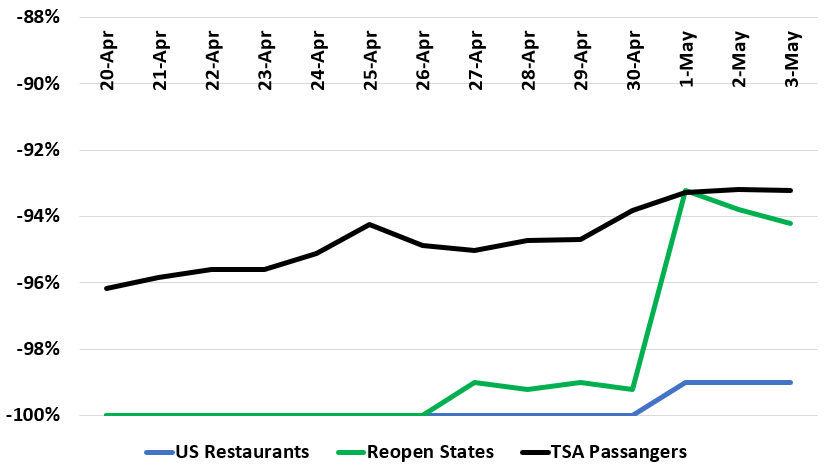

It’s been a week or so since some states have chosen to reopen. Let’s see how that has impacted flying and restaurant traffic.

As you can see the recovery is shallow even in those states that have started to reopen. Restaurant traffic is still down 94% in those states.

Flying has started to recovery, but is still down 93% (instead of 96%) year-over-year.

Based on this data, we cannot expect a V-shaped recovery for the U.S. economy – EVEN if all states reopen.