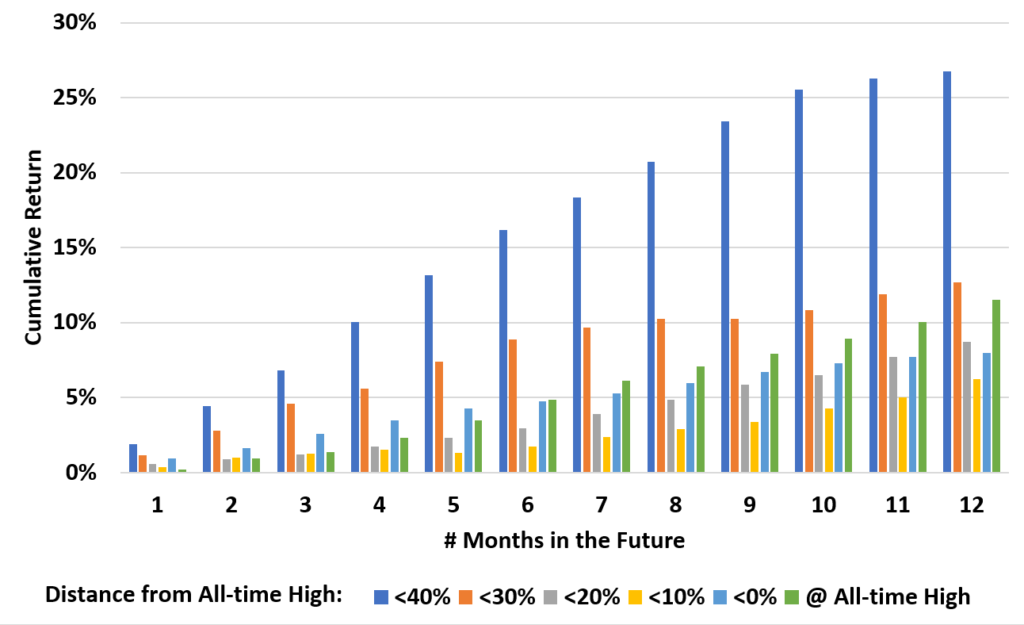

Given the stock market is at all time highs, lots of questions about whether it’s too late to buy. Historically, except for after a big crash, all time highs are the time to buy.

Below I graph cumulative returns for the next 12-months based on how far the market was from its all time high at the start of the month.

As you can see, the return pattern is a U-shape. If the market is down a lot, it’s a good time to buy. If the market is at an all-time high, it’s a good time to buy.

While this may seem counterintuitive, research has shown the market has a lot of momentum. Thus, when the market has done well, it tends to continue to do well.