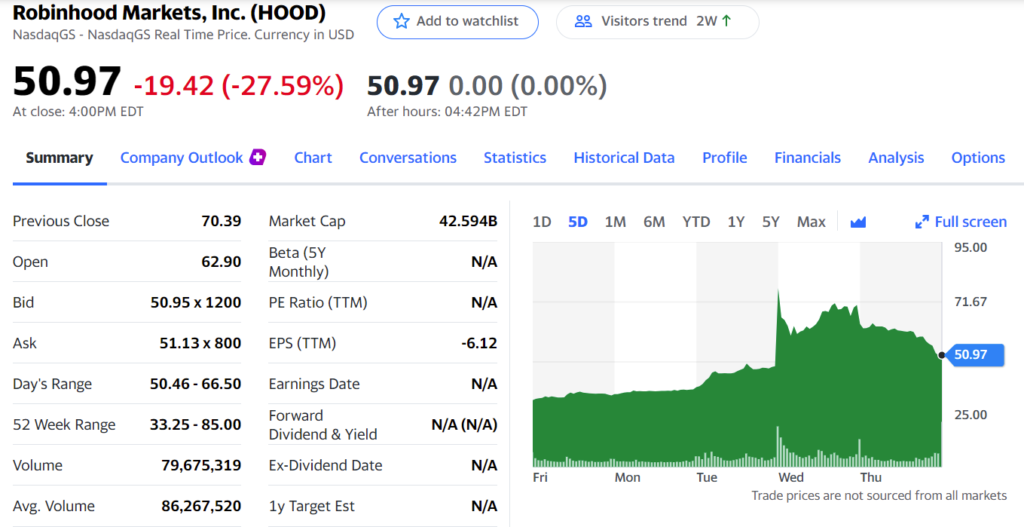

Robinhood announced their earnings yesterday. The list of how they make money pretty much shows you everything wrong with how they make money.

- Crypto made up 50% of revenue last quarter

- 62% of that revenue is from … DOGEcoin

- 60% of new accounts traded crypto for their first trade – more than they traded equity

Note there is no real regulation on crypto execution. Robinhood makes money by “… routing orders to market makers that the company says offer “competitive pricing” and taking a percentage of the order value.”

The bottom line is that, as I’ve stated before, Robinhood’s business model requires suckering people into givng new money to buy the next hot thing.

The best investment advice I can ever give you is to NOT do whatever the Robinhood traders are doing.