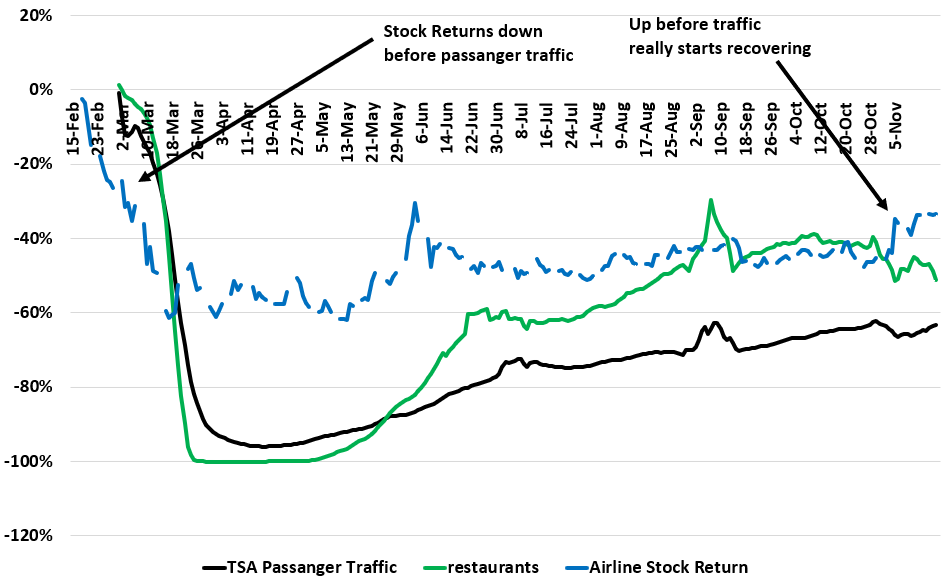

As COVID cases have picked up here in the U.S., restrictions have increased. But you don’t need restrictions as people will voluntarily avoid restaurants and travel. You can see this in the graph below as restaurant traffic is down and TSA data has been flat.

The really interesting thing is how much the stock market has a forward discounting mechanism. I have plotted Airline stock returns starting on February 14th.

Airline stocks were down almost *30%* before the passenger traffic started declining here in the U.S. Now, these stocks are the same price as they were before traffic started to decline, even though passenger traffic is down 65% still.

This is what the market does and why sometimes the stock market seems crazy. It’s being crazy like a fox by figuring out where things will be in a few months, not where they are today.