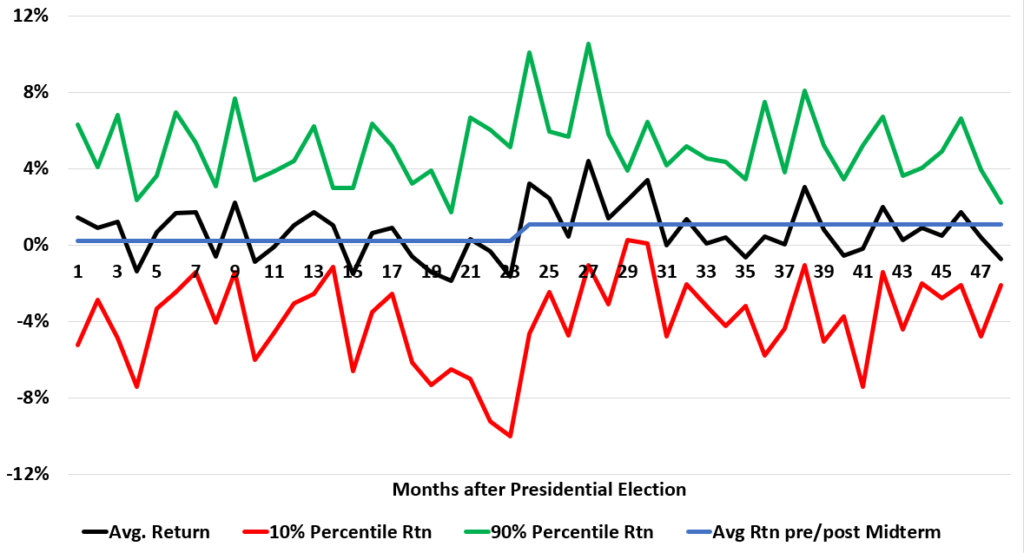

We are just 28 days from the 2020 Presidential Election. Does the election cycle matter for the stock market?

Here’s the average return each month for the 4 year election cycle. I use returns since the 1960 election. I also include the 90%/10% percentile returns to give you a range.

The bottom line is there isn’t much of a pattern around the election itself.

With that said, there seems to be a big of a short-term hit right before the midterm elections and then a boost in returns after. It is statistically significant. (0.2% per month for the 2 years before, 1.1% per month after)

Overall, there is not a strong, linearly pattern between the cycle and returns.