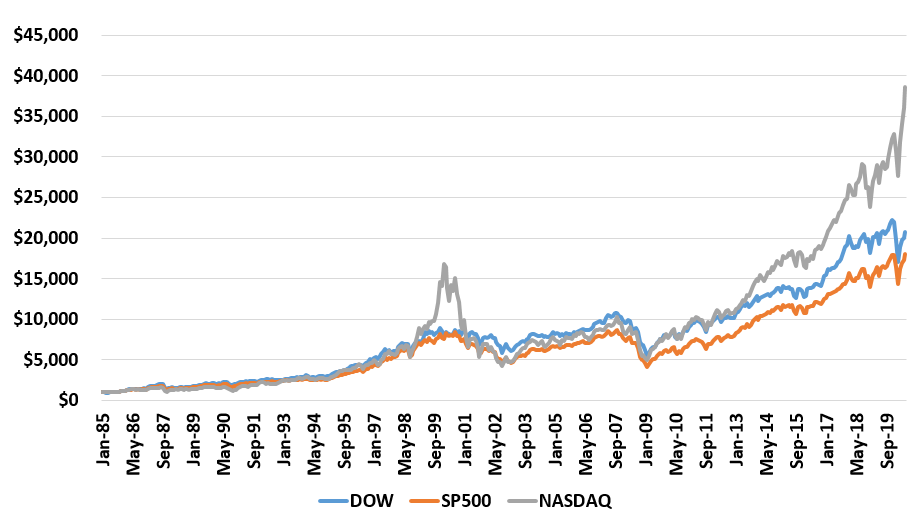

One of the most interesting things in the stock market right is the NASDAQ vs. the SP500/Dow. Here is the cumulative return of the three indices since 1985.

Generally, you can see the indices all follow each other. However, you can see the 1990s Internet bubble is one place the NASDAQ pulled away. 2020 is another.

In fact, the NASDAQ has got vertical here in 2020 and the difference between the indices is close to an all time high. Note this isn’t because of AAPL, AMZN, etc because those are in the S&P 500.

The question is: will these indices come back together again? And if they do is that because the S&P500 goes up a lot? Or the NASDAQ comes down a lot?