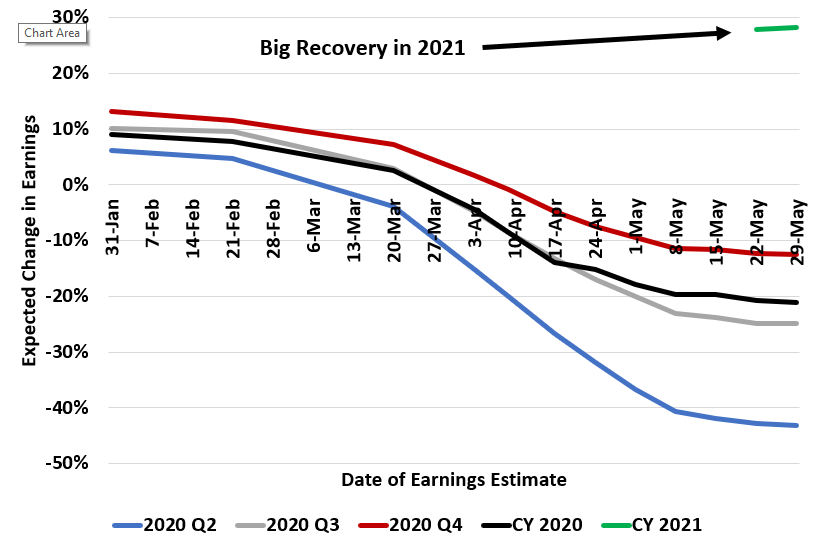

So why are stocks so high again? It comes down to the recovery in earnings. Here is data from Factset on earnings expectations the rest of the year and now 2021.

You can see two things. First, earnings expectations for the year are now starting to flatten out. But now we have an idea of earnings expectations for 2021: Growth of almost 30% over 2020. That would make 2021 earnings equal to 2019 earnings.

The question is will earnings recovery that quickly. In the 2007-09 recession, it took earnings 4 years to recover. In 2001, it took earnings 3 years to recover. This would be 2 years.