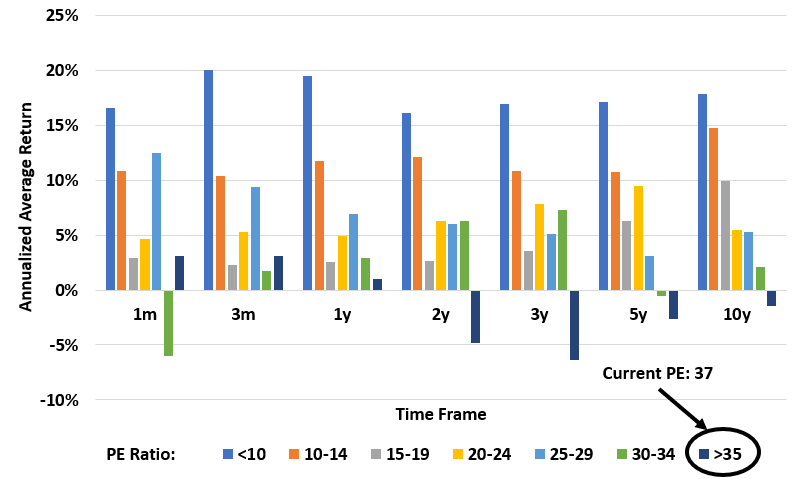

A few days ago, I showed that price doesn’t really matter for stock returns. Today, I show you that value does matter. This chart shows you the average annualized returns over future time periods based on the current P/E ratio. The pattern is clear.

Average stock returns when P/E ratios are high (aka stocks are expensive) are much lower than when P/E ratios are low (aka stocks are cheap.) Note P/E ratios here are measured using the “CAPE” ratio developed by Nobel Prize winner Robert Schiller.

The current P/E ratio is 37. This indicates that future returns are going to be low over the next 10 years on average. Note this doesn’t mean we will crash or that we are in a bubble. It just means returns will be low going forward.

That doesn’t returns can’t be good for the next year, but it is clear the historical pattern is not positive here.

(Data from 1927 to now)