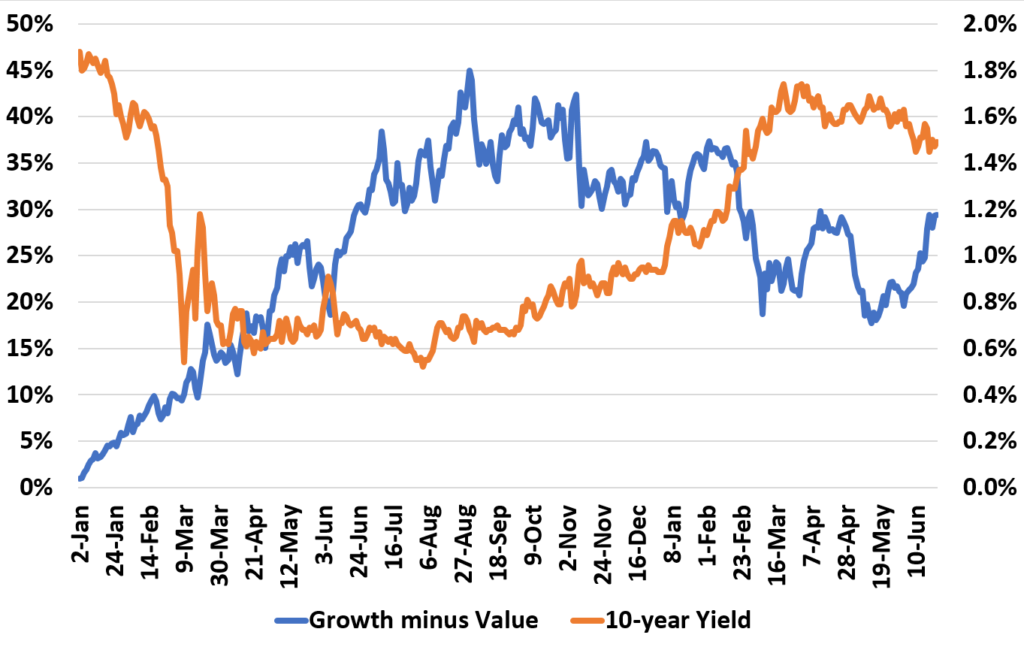

When it comes to financial markets, the Fed is the Boss. Why? They impact everything. Just look at the returns of growth vs. value stocks and the 10-year interest rate over the last 18 months.

While you may think I’m displaying the yield vs. price of bonds, the blue line is actually the different in the cumulative return of growth and value. You can see as rates dropped, growth soared relative to value. When rates started to climb the trend reversed.

Now rates have started to fall again and growth has picked up again.

Why is there this relation? It’s time value of money. Value companies have earnings now. Growth companies will have earnings in the future. As interest rates go down (up), future (current) earnings become more (less) valuable relatively speaking.

The question is: does the 10 year keep going down? We’ll get to that later in the week.