As I have been warning, Hertz stock is worth nothing. Today it is back down to $1.20 after being as high as $6.50.

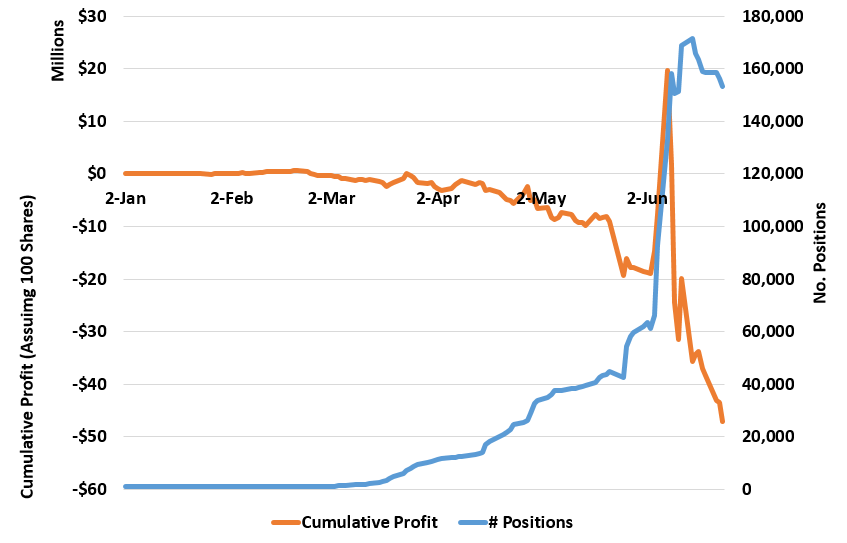

To show you how retail investors buy high and sell low, here is the cumulative loses for Robinhood traders (Assuming 100 shares per position) for 2020.

You can see the cumulative loses are now approaching $50 million at a minimum. Of course, the good news is the most that can be lost now is another $15 million or so.

The bottom line is this behavior is pervasive with retail investors and why the average 401k earns way less than the averages.