The Definition of “Priced In”

In finance, we talk about how future growth is “priced in.” Whelp, Tesla has priced in becoming the entire car industry. In fact based on industry multiplies, it’s overpriced even if it was the entire industry.

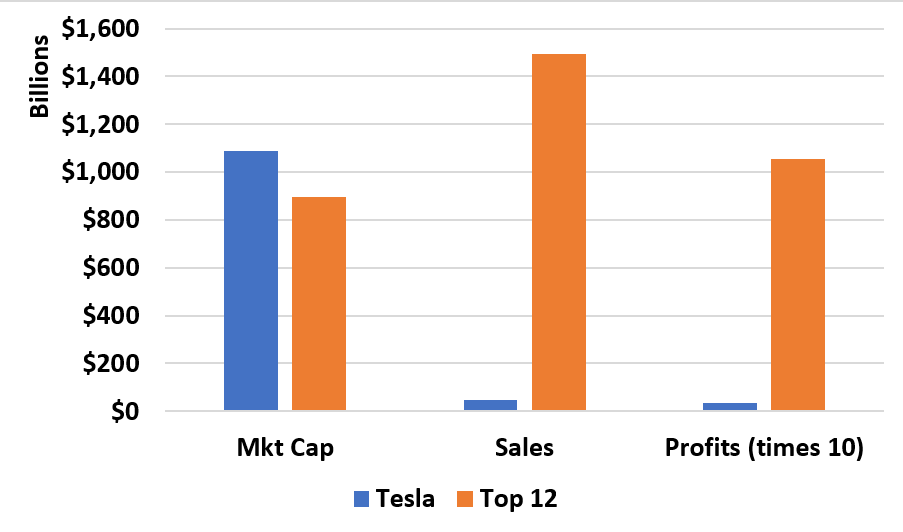

This graph has the market cap, sales, and net profits for Tesla versus the 12 largest car manufacturers in the world (not Tesla) – Toyota, VW, Daimler, BMW, Ford, GM, Ferrari, Honda, Subaru, Nissan, Hyundai/Kia, and Mazda.

The graph tells the story. All other car companies have 97% of profits and sales, but are worth less than Tesla.

In fact, if Tesla were to become the entire car industry – $1.542 trillion in sales and $110 billion in profit – based on the price ratio for the rest of the industry, it should sell $926 billion (Sales) and $937 billion (earnings).

This price is not justified by margins: Tesla’s profit margin is average for the industry. And it’s not due to the industry high growth, which is 4% per year on average over the last 5 years. The actually capabilities of its self driving software are ranked well below companies like Waymo and GM.

I guess investors really like the solar business.