The Market is Really Concentrating

So far this year the S&P500 is up 13%. Of that 13%, the top 5 components – Apple, Amazon, Google, Nvidia, and Tesla – account for 12.5%. In other words, the other 495 companies are flat for the year. It’s by far the most concentrated market EVER.

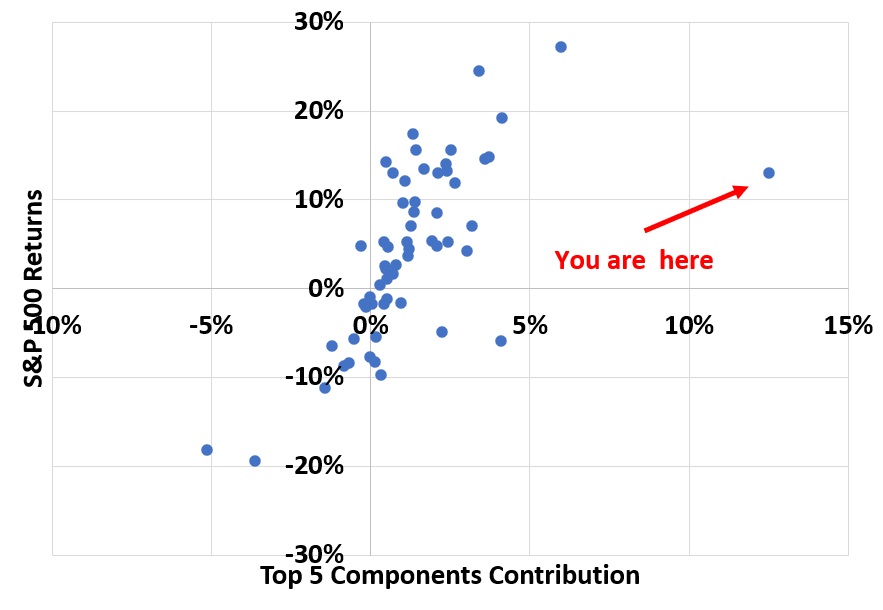

Here’s a dot plot of the S&P500 return through June 12th for each year from 1965 to 2023. The y-axis is the S&P 500 overall. The x-axis is the contribution from the top 5 stocks.

As you can see in a typical year, the top 5 components account for about 20% of the SP500 return (either positive or negative). There are very, very few years that deviate. This is because the top 5 components make up about 20% of the index weight in an average year.

This year? it’s not even close. It’s an outlier of outliers. Essentially 100% of the return is made up of 5 stocks. One of which is now trading ta 40 times sales. Note all of these are NASDAQ stocks, which is why the NASADAQ is up 30% and the Dow is up 2%.

The question is what happens the second half of the year. That’s hard to say. We are in unprecedented territory here. The one thing I know for sure is that these companies can’t go up another 40-50% the rest of the year and the rest of the market goes nowhere. If that happened, they would represent 40% of the market cap of the S&P 500.