War of the (Interest Rate) Worlds

Last week I posted about demographics and rates. Why is this so important? Financial markets and correlations are COMPLETELY different in rising and falling rate environments.

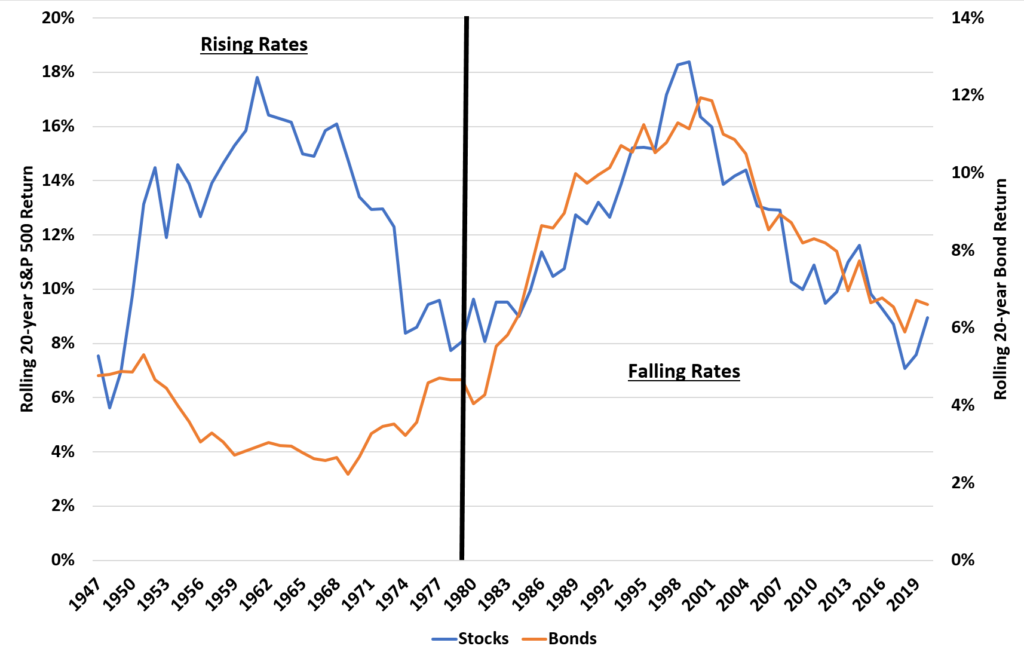

Below I graph the rolling 20-year S&P 500 total returns and a 50/50 bond portfolio of treasuries and investment grade corporates.

Four important takeaways:

- During rising rates, bonds greatly underperform as their income is offset by capital losses due to rising yields. Stocks can do well if they can pass inflation along to consumers. Thus a pretty negative correlation between rolling returns.

- During falling rates, bonds get a boost to their income from capital gains. Lower rates make stocks look relatively better which also pushes their prices up. Thus, the very positive correlation between returns.

- Because of these two points, the “classic” 60/40 portfolio works well during falling yields. You get the diversification of bonds but don’t get up much return.

- Finally, and perhaps most importantly, you can see rolling rates of returns are declining. This goes back to the excess capital comments from last week. We have tons of capital. Returns will continue to decline over time as our population gets older.