“We’re Streaking through the Market!!”

(Reference from Old School)

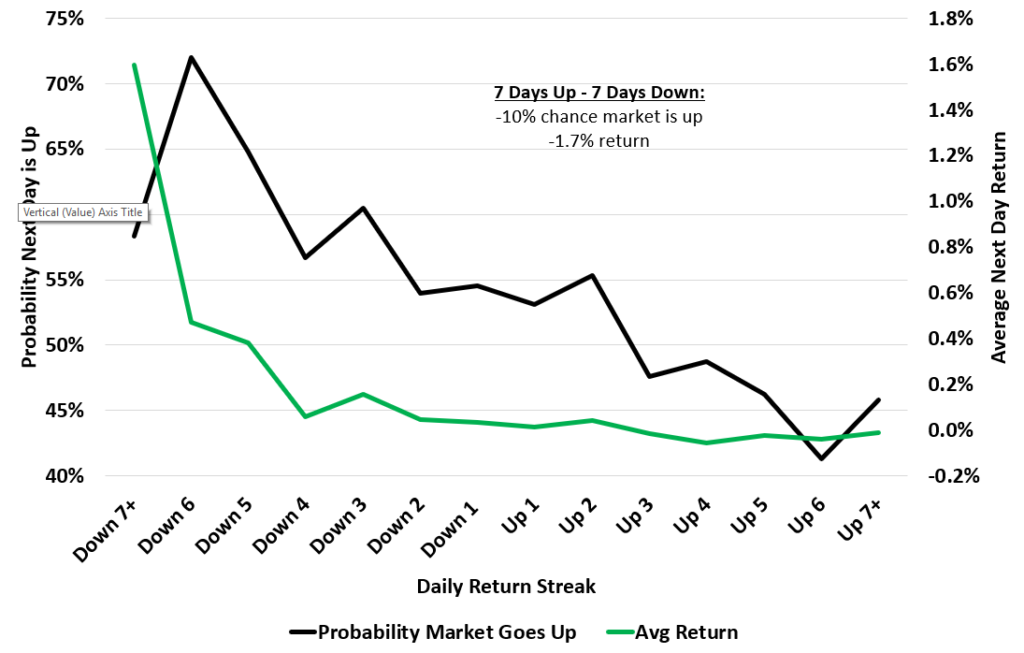

The stock market is not completely random – it’s mean reverting over time. Just to provide it: Here’s the next day avg. return and probability of going up based on the number of consecutive days the market has gone up or down.

You can see the probability the market goes up and the average return almost monotonically declines from the most negative streaks to the most positive streaks.

This is one of the reasons the average investor gets killed. Fear on the low end causes them to sell and miss the rally. FOMO on the high end causes them to buy at the wrong time.

Pay attention to the current streak when you are compelled to buy or sell. If you want to sell after 5 days down, it’s probably a bad time.