Saved with a Refi? Not as Much as You Think

Recently refinance your mortgage and excited by the savings? Bad news: The savings is probably about 50-60% what you think it is. The rest is time value of money trickery.

If you are like most people, you have probably refinanced a few time over the last decade. Why is this important? Well, you probably refinanced into a 30 year loan again from your original 30 year loan.

The refi pushed your payments out. Thus, you save today, but pay tomorrow. Just to give you an idea of the trickery on 30 year mortgages:

- @ 3.875%, a $500k loan has a payment of $2,351

- @ 2.875%, a $500k loan has a payment of $2,074

Not too bad – you saved $280 a month. But I’m guessing your actual savings was more than that. Why? Well, let’s say your mortgage was 5 years old at 3.875%. If that’s the case, then your loan balance was only $450k when you refi’d. Let’s wrap in $3800 of fees and now here are the payments:

- @ 3.875%, a $500k loan has a payment of $2,351

- @ 2.875%, a $500k loan has a payment of $2,074

- @ 2.875%, a $454k loan has a payment of $1,885

You save another $200 from the fact your loan balance was down. Thus, about 40% of the savings you see in your payment is just time value of money stuff, nothing to do with a lower rate

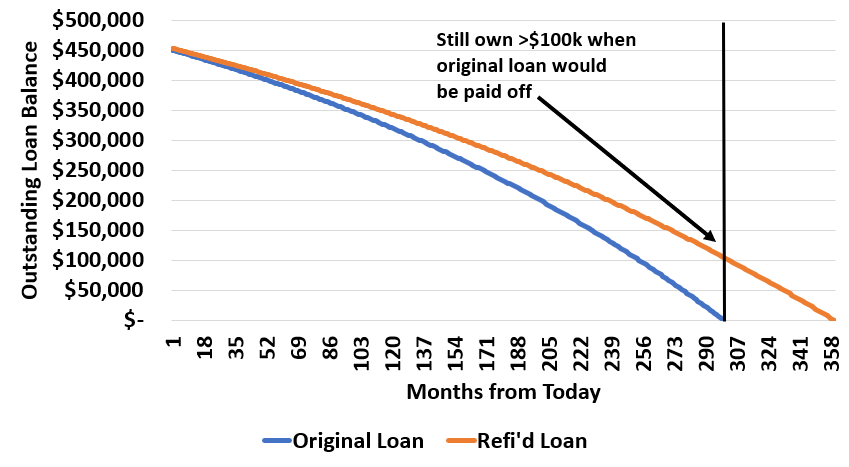

What does this mean long-term? Here’s how much you’ll owe on your house over the next 30 years comparing your two loans.

In 30 years when your original loan would be paid off, you’ll still owe $105k on your house.

I’m not saying refi-ing is a bad thing – it isn’t. Just understand a lot of the savings is from pushing out the loan. I got a 30 year mortgage in 2009 on my house. In 2021, I’ll still have a 30 year mortgage.