Thank you to everyone who came out to the Newport Beach Chamber’s 2023 Economic and Financial Forecast at the Balboa Bay Resort. As always, I am humbled by the number of people that turn to me for economical and financial advice.

My overall themes were:

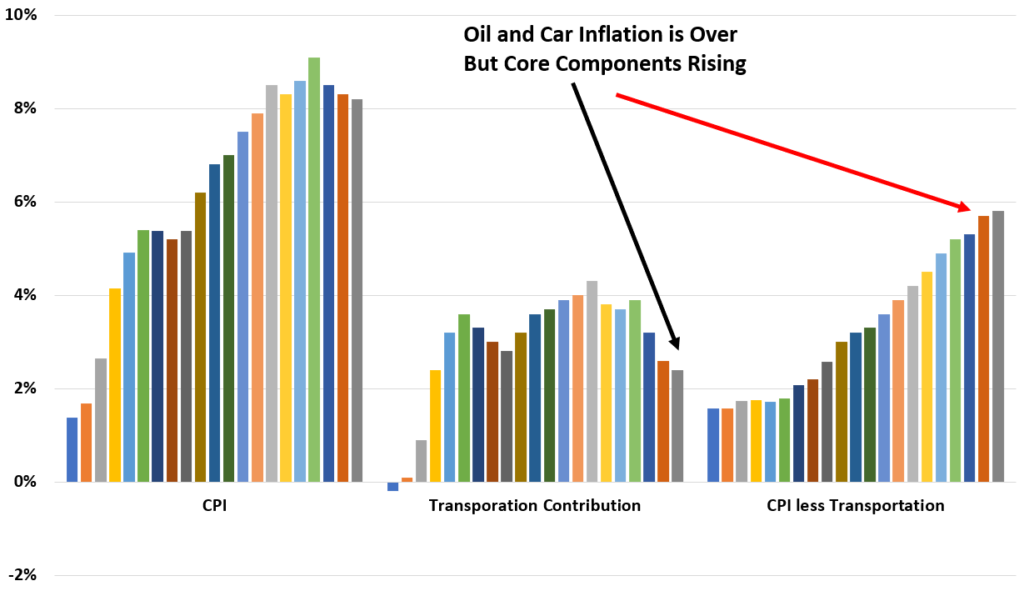

- We have inflation because we gave out too much money

- Inflation will be a problem until the labor market cools

- Likely recession in 2023 as the Fed overshoots (almost has to at this point)

- Depth of recession depends on how much the Fed is willing to tolerate 3-4% inflation

- Stocks are going nowhere. When rates start coming down (bullish), earnings estimates will start coming down (bearish)

- Long-term bonds seem like an opportunity to me.

For those interested, here is my slide deck: LINK