Inflation is Still a Problem

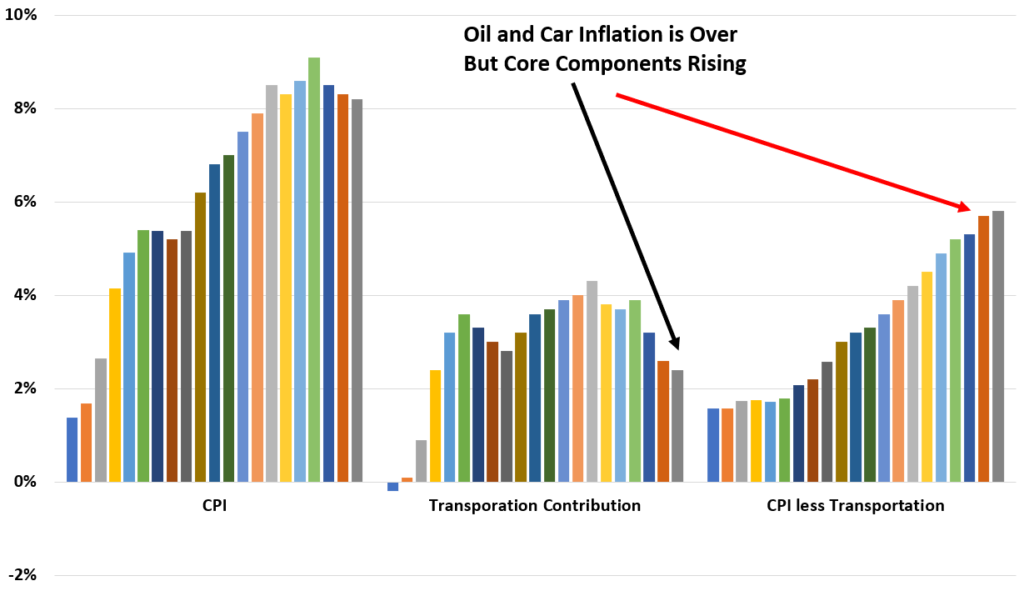

September CPI is again hotter than people expect. People don’t understand it’s not oil driving these number: It’s labor related issues. Until the labor market cools, we have a problem. Here’s my breakdown of CPI.

You can see used cars and oil inflation is way down. But you can see the core components are hotter than before.

With that said, I’ll give you two positive things: 1) It looks like the core component part is slowing and 2) You can see the 10 year bond hasn’t gone over 4% on this number.

As noted many times, the Fed will need to be aggressive until labor market breaks. And I think long-term bonds are a safer place to be as yields may have peaked.