In this Stock Market Rally, Size Matters

One of the my theories about this recession is the rules and support may be favoring big business over small business. Stock market returns backup this thinking.

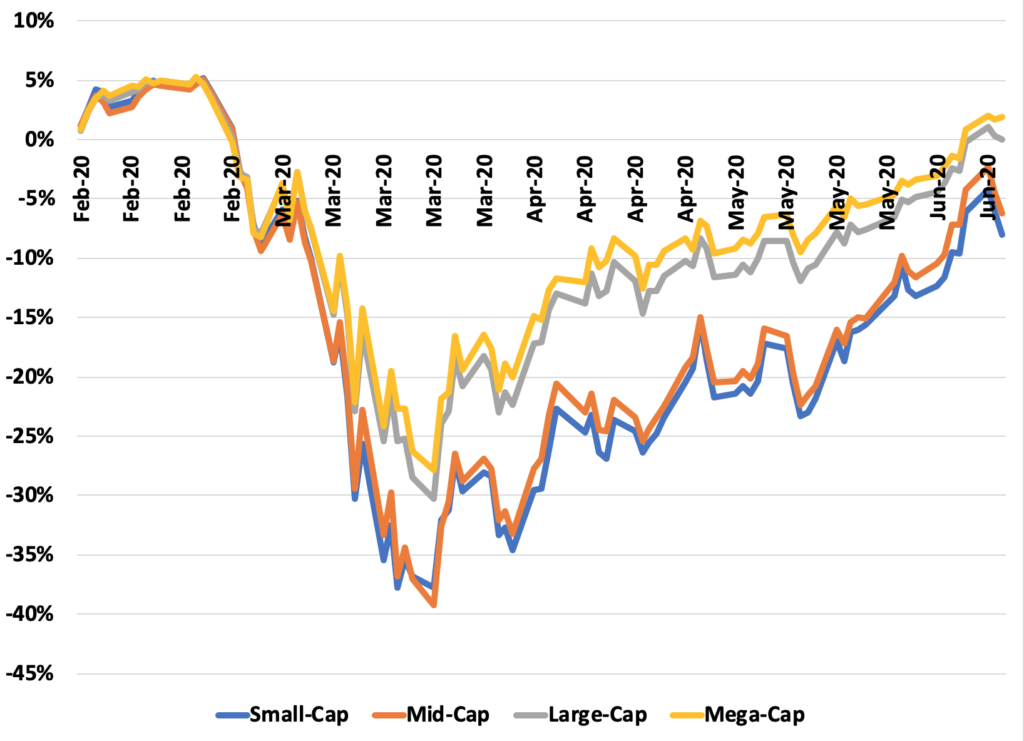

Here’s the stock market returns since February for Small-caps (IWM), mid-caps (MDY), large-caps (SPY), and Mega-caps (OEF).

You can see how large and mega cap companies have been leading the charge.

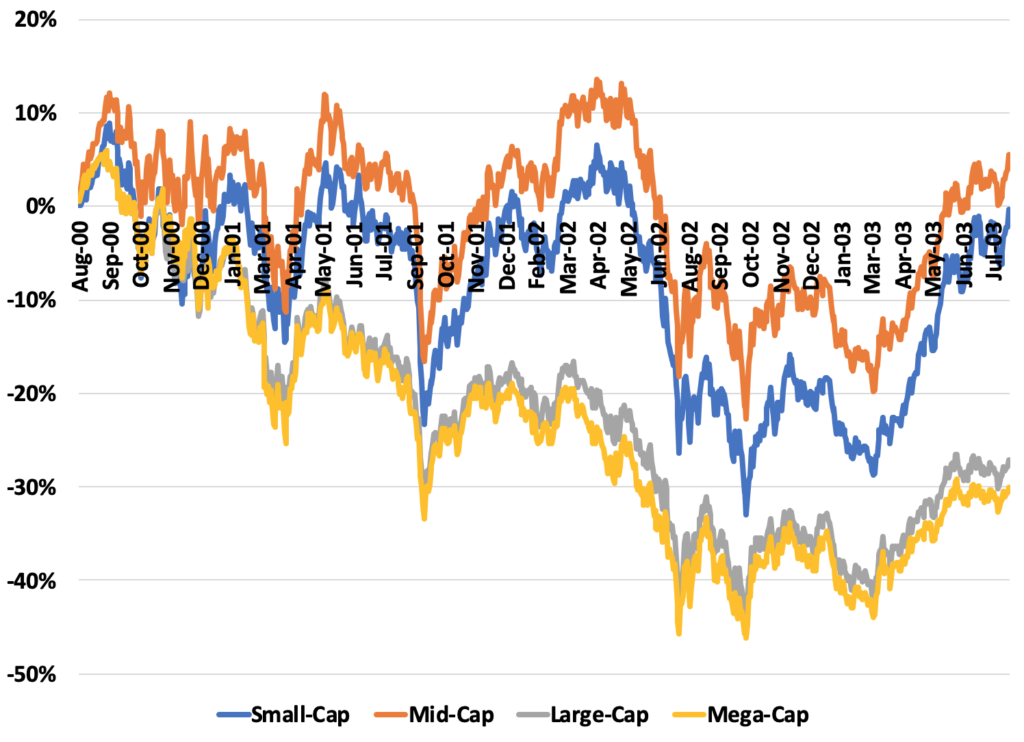

This is unusual. In past recessions, small and mid caps lead the way. Here are the returns from the tech bubble.

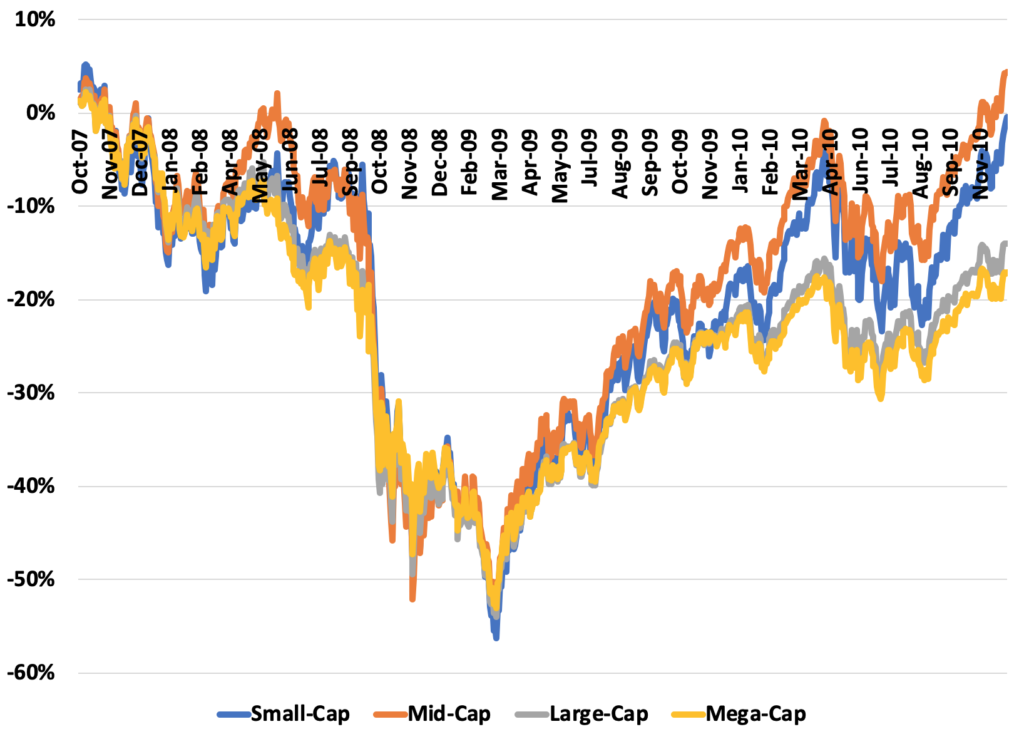

And here are the returns from the financial crisis.

These results suggest the bailouts and rules favor big business over small. If we had private mom and pop businesses on here, I think the results would be even more dramatic.