Inflation Expectations are… well, Inflating

One of my concerns is that the reduction in supply for products due to closed businesses and supply chain issues coupled with stimulus money will lead to inflation. The market is starting to expect more inflation as well.

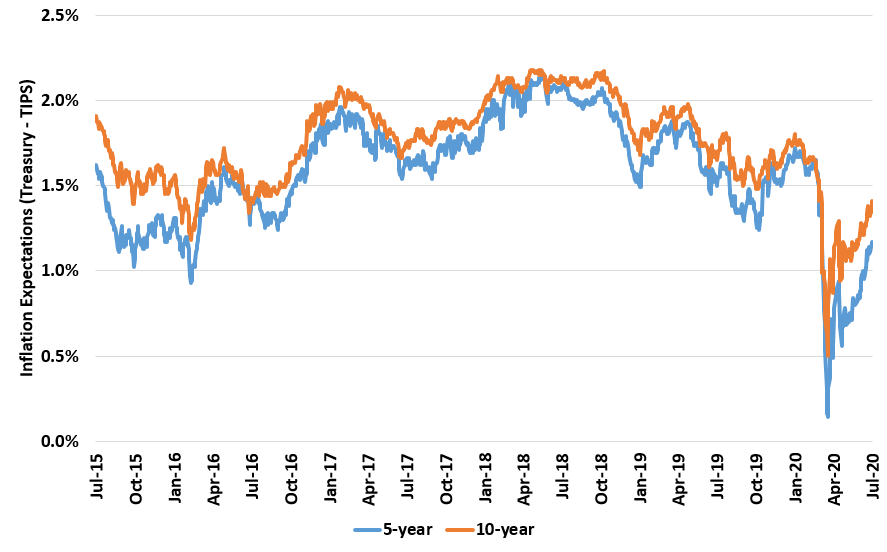

This chart is the Treasury Yield (Nominal) minus the TIPS yield (real), which gives you inflation expectations.

When the crisis first hit, inflation expectations for the next 5 to 10 years crashed and were at less than 0.5% per year.

Now inflation expectations are 1.2% per year for the next 5-years and 1.4% for the next 10-years, up quite a bit from the bottom.

I expect inflation expectations will continue to increase from here, giving a boost to Gold, TIPS, and firms with good dividends and pricing power.