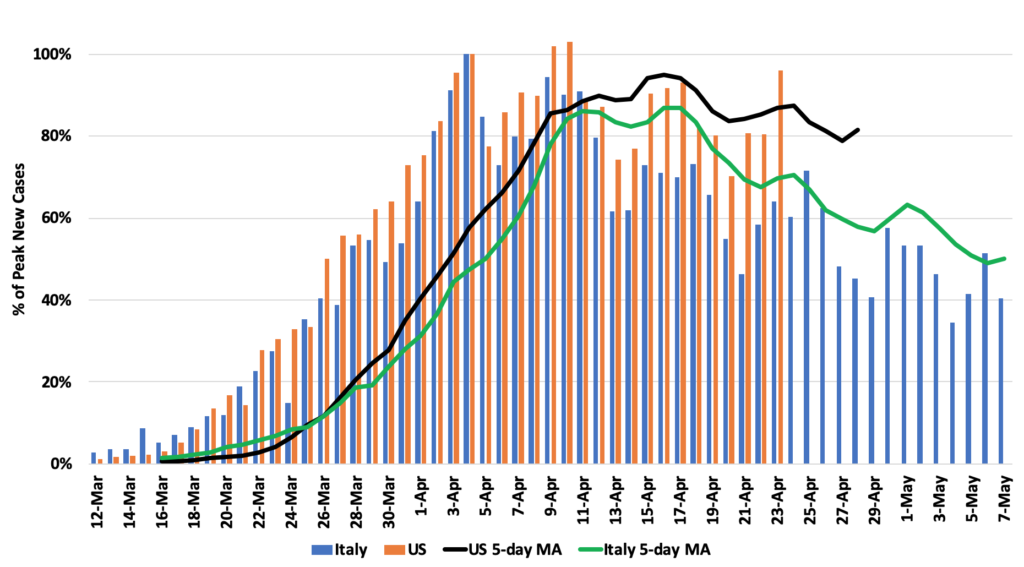

For weeks, I’ve expected the U.S. to largely follow the path of Italy – and so far it has. Unfortunately, the last few days, U.S. cases have not been declining as fast as Italy.

As seen in the graph, the cases matched well until about April 11th when the US has started staying much higher than Italy.

If we calculate a 5 day average of cases to remove testing variability, we can see the US is now close to 80% of peak cases while Italy was only 60% at this time.

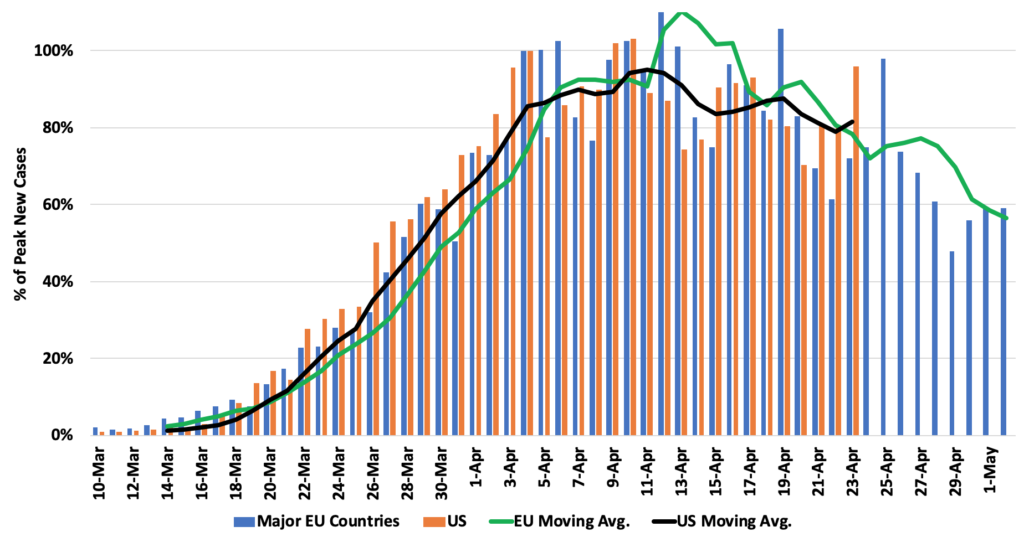

It seems rather – and probably naturally – that we are now closer on the EU path. Like the EU, we have different ‘countries’ (i.e. states) with different restrictions. This is expanding our plateau period

Note, however, that both Italy and the EU graphs suggest about 60% of peak cases in the US on May 1st. Thus, it is possible we end up converging still.

A good reason for the increase in cases yesterday is better testing – so that is a good thing.