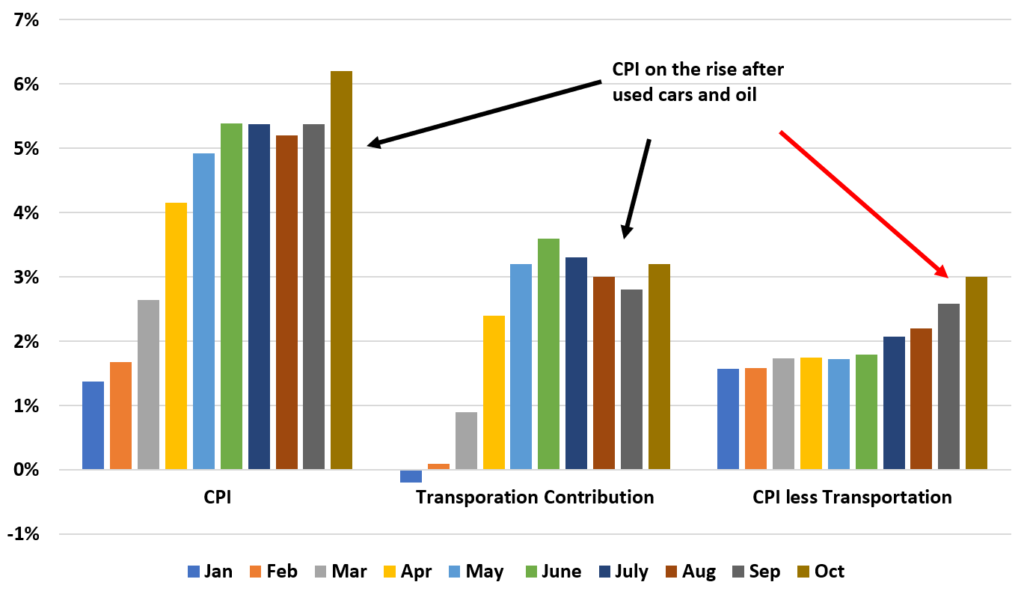

The latest CPI update will come out tomorrow and it will be all bad news. Rents will be worse. And even though oil/gas prices haven’t gone up much, they will still increase CPI. Why? Because they should be going down.

Here’s a chart that shows gas prices this year as well as the average price of gasoline each month as compared to the month of June when prices are the highest.

This time of year gas prices should be going down. In fact from Oct to Nov prices should have declined 4%. Since they didn’t … that will make inflation even worse.

The expectation is that CPI will be up 6.7% year over year. We’ll see what the market thinks about the report tomorrow. This is probably the most important economic report of the month (usually is payrolls).