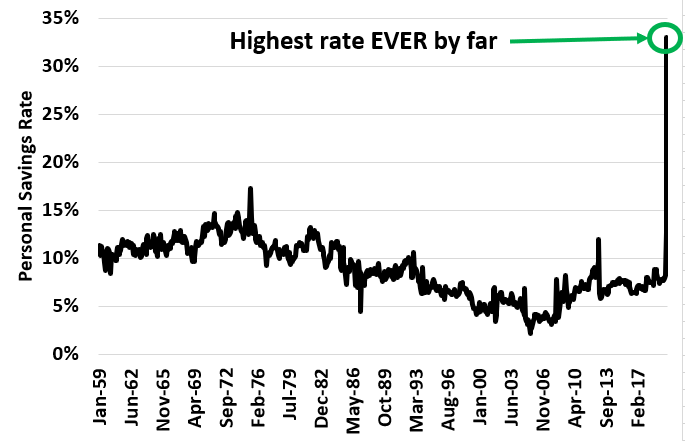

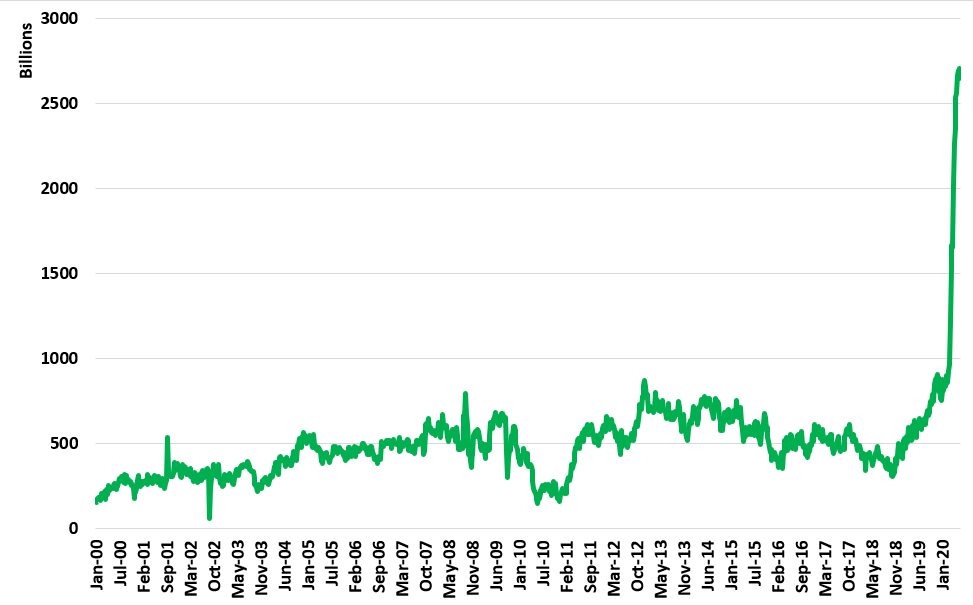

Over the last 3 months, the U.S. Government has provided a huge stimulus to the economy – perhaps more than the economy lost from shutting down. On top of that, people had no where to spend money. The result? An enormous rise in deposits at banks.

Deposits are up almost **3** trillion dollars over the last year. This is currently how a lot of people feel:

The question is what happens with all of this money. If everyone tries to spend it at once, there could be a massive inflation issue.