The market is off to a tough start this year, especially with stocks that did well the last 12-18 months. Prices are down, but stocks are not cheap – thus, we are in no man’s land. So what do we do now?

To illustrate what I mean, here are a couple examples of companies:

- Rivian: -85% from high, trading at 12.2 times forward SALES

- Snowflake: -60% from high, trading at 25 times forward SALES

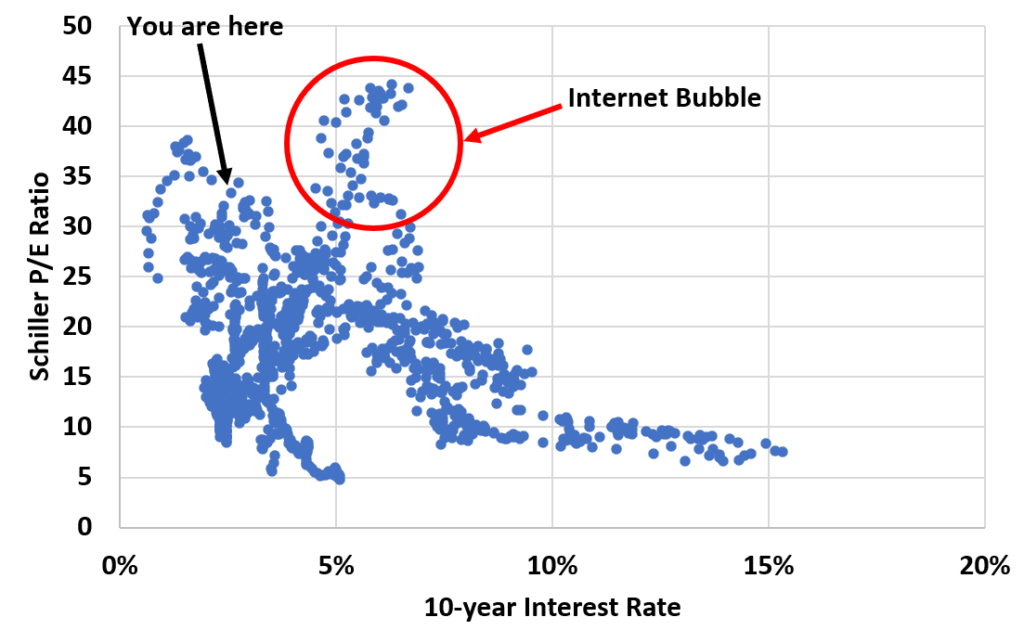

And there are many others. These companies are down huge, but they definitely aren’t cheap. If you look at the market overall, here’s the relation between interest rates and Schiller P/E.

With rates now at 3%, the market has a higher interest rate AND P/E ratio than in 2019, which wasn’t exactly a cheap market. You can see this in the graph- we aren’t a dot all by ourselves, but we are still around the top dots at the current interest rates.

Thus, the market isn’t nearly as pricing – especially for many darling stocks – than it was just 4 months ago. But the market isn’t exactly cheap. There are still a ton of headwinds that will probably prevent a huge rally. (Earnings likely need to come in, economy slowing, rates up, aggressive Fed, inflation) So what’s my advice?

My guess is we will have a very choppy rest of the year with big rallies and likely larger declines. It’s hard to do but … sell into the rallies, buy into the dips. I’ll look to do this, but only names I’m not worried about going bankrupt in the next 3-5 years.