Beyond Meat is down sharply today after a bad earnings miss. Not only that, but the CFO has some interesting comments on the call that sounded Worldcom style. BYND has a lot of advice for investors today.

Beyond Meat IPO’d back in 2019. It quickly got up to almost $250 a share, which valued the company at close to $13 billion. At that time, the company had about $150 million in sales, giving it a Price to Sales ratio of “only” 85.

At the time, I told everyone that was crazy. In 2019, Hormel – another food supplier – had $9.4 billion in sales and a market cap of $23 billion. Even better, Tyson is another meat provider that had $42 billion in sales and a market cap of $30 billion. In other words, Beyond Meat was priced already like it had close to $5-10 billion in sales.

When I would bring this up, people said it’s a TECHNOLOGY company, not a meat producing company. Sound familiar? People said valuation doesn’t matter with a company with this fast of growth. Sound familiar?

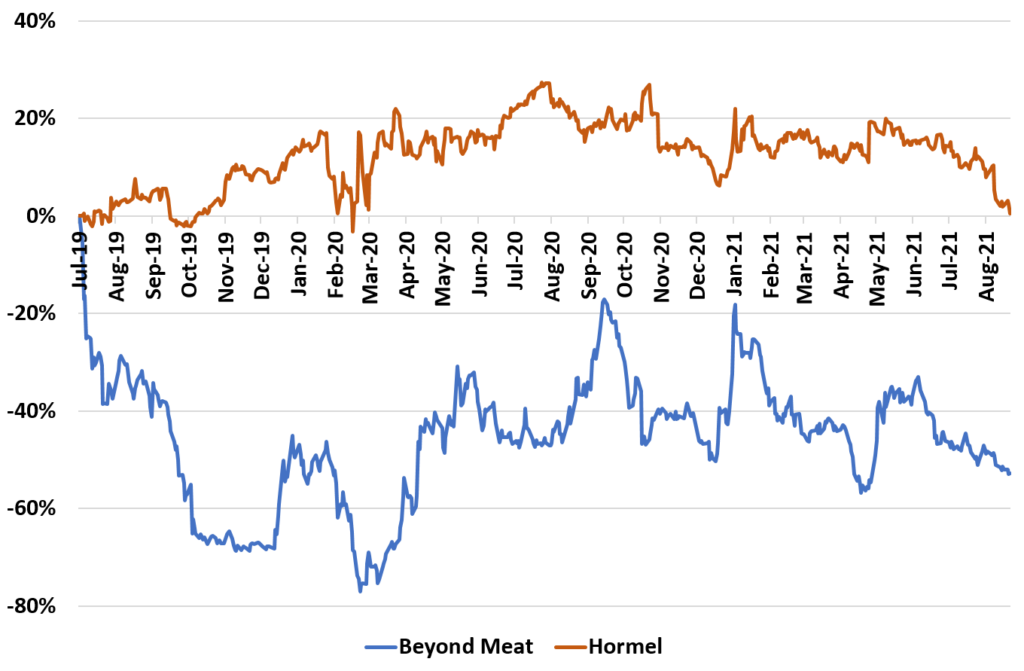

Well it’s still down 67% from that point. The SP500 is up 54% since then. In other words, BYND has under performed the market by 80%. It’s sales have increased … to $450 million now. With a market cap of $5.2 billion that still gives it a price to sales ratio of 12.

Oh and by the way … the company has never made money.

And then there is this great quote from the CFO today: “We did capitalize some of the costs this quarter when we were running sort of less than optimum as we struggle through some of this stuff. So there is some cost on the balance sheet that will play out.”

I’m not an accountant, but that doesn’t sound GAAP correct to me. Worldcom did the same thing to goose it’s earnings and that didn’t turn out well.

Today’s market is expensive due to interest rates but some stocks are more than just expensive. Just remember at the end of the day every company just sells something (cough cars) and valuation does matter.