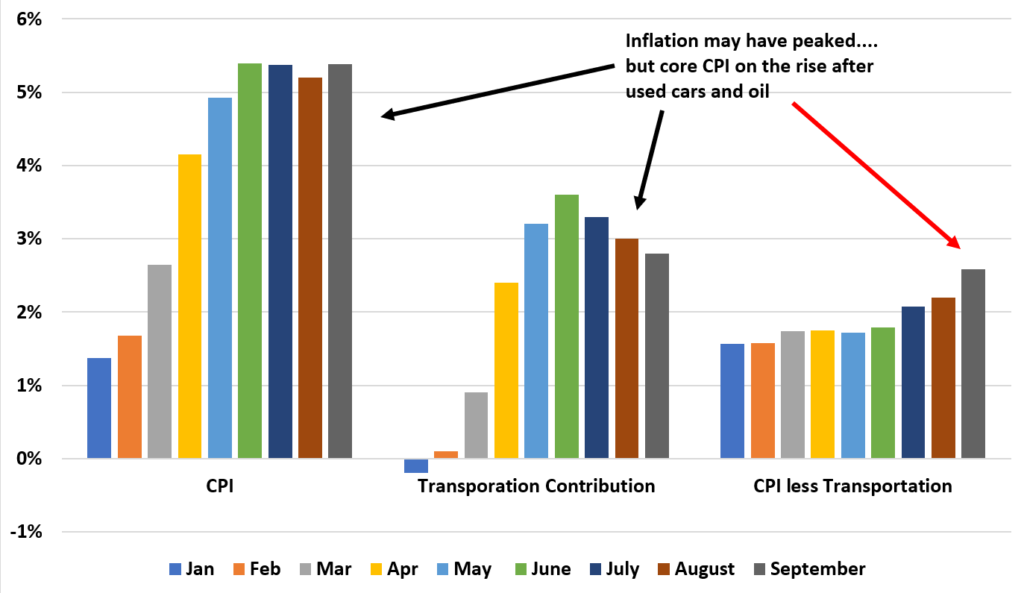

Today’s September CPI came out with year over year inflation at 5.4%. While it may seem like core CPI was good news, we continue to see temporary aka transitory inflation becoming more and more persistent aka permanent.

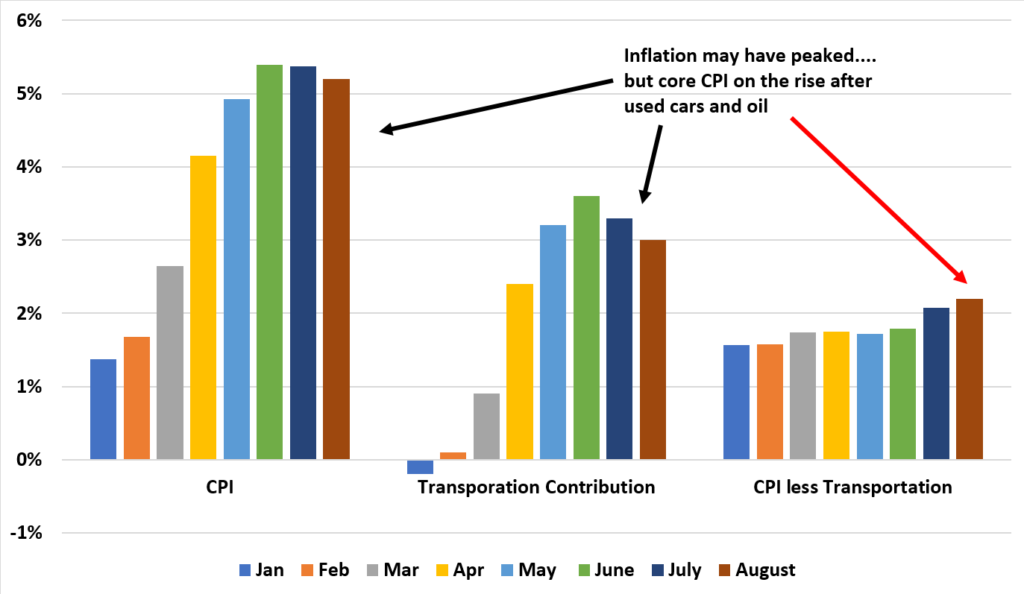

This is the graph I have been posting where I remove oil and used cars from the CPI and get what I’m calling ‘core’ CPI.

You can see that CPI is peaking here just over 5%, but you can also see that the ‘core’ part of CPI is more approaching 3%.

As I stated in the Econ forecast, supply chain issues are going to take a loooooong time to fix. Unless the economy completely craters, inflation is here to stay.