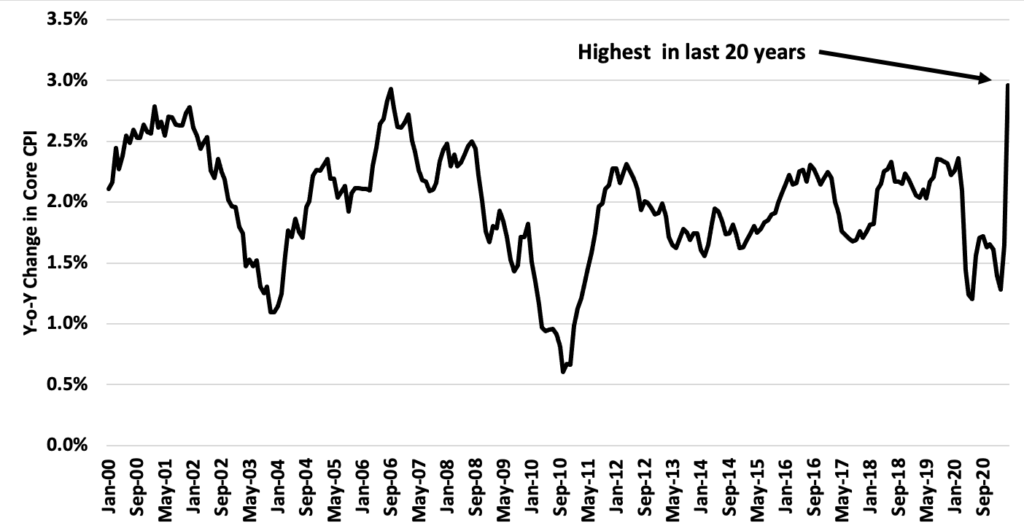

Core CPI was this high. As predicted months ago, we start to reopen and inflation is starting to go up. Why? Everyone has cash money to spend and the supply chain is a mess.

The scary part is we have some negative months yet to roll off. I wouldn’t be surprised if core CPI hits 3.5% – 4% by June/July.

The question… is this “transitory” – i.e. a one time bump as we reopen due to supply chain issues or does this inflation seep into wage growth and, coupled with even MORE government stimulus, become something the Fed needs to act on.