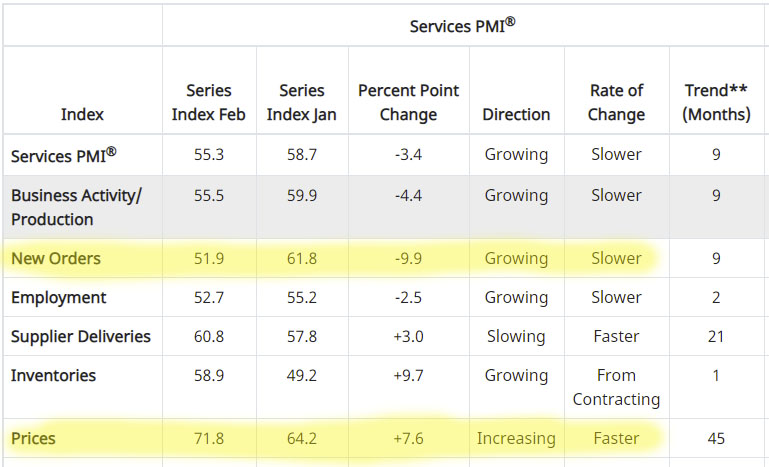

This morning’s ISM Service sector report is putting some fear into the markets – especially the bond market. Here’s a piece of the report below with the key details highlighted.

Growth (new orders) is slowing while Prices are accelerating. This is the classic 1970s worry about stagflation (low/no growth but inflation).

This is likely to be a theme as we continue to reopen.